Artificial intelligence, or AI, has emerged as one of the most powerful technologies in recent times. From boardroom discussions to dinner table conversations, it has penetrated our lives beyond imagination.

With generative tools making headlines, AI has become more mainstream. Suddenly every other startup is centered around this technology and every other consumer wants an AI-powered solution.

However, most of them have limited means to gauge the actual impact, potential, and value proposition of the AI technology they are planning to invest in. This lack of comprehension and information is leading to hype and chaos that may be an indication of an asset bubble.

From the infamous dot-com bubble to the South Sea, China, and Tulip bubbles, history is full of examples of asset bubbles that shook the market and caused a long-term impact on the socio-economic conditions.

So, is the popularity and proliferation of AI technology leading to the formation of a bubble? Are we headed towards an AI bubble crash? If these are the questions that intrigue you, you have landed in the right place. Continue reading and find out what the future holds.

In this blog

- The history and rise of Artificial Intelligence

- The AI phenomenon: An introduction

- Is AI the new dot-com bubble?

- What are the factors responsible for the AI bubble?

- Is the AI bubble about to burst?

- Frequently asked questions

The history and rise of Artificial Intelligence

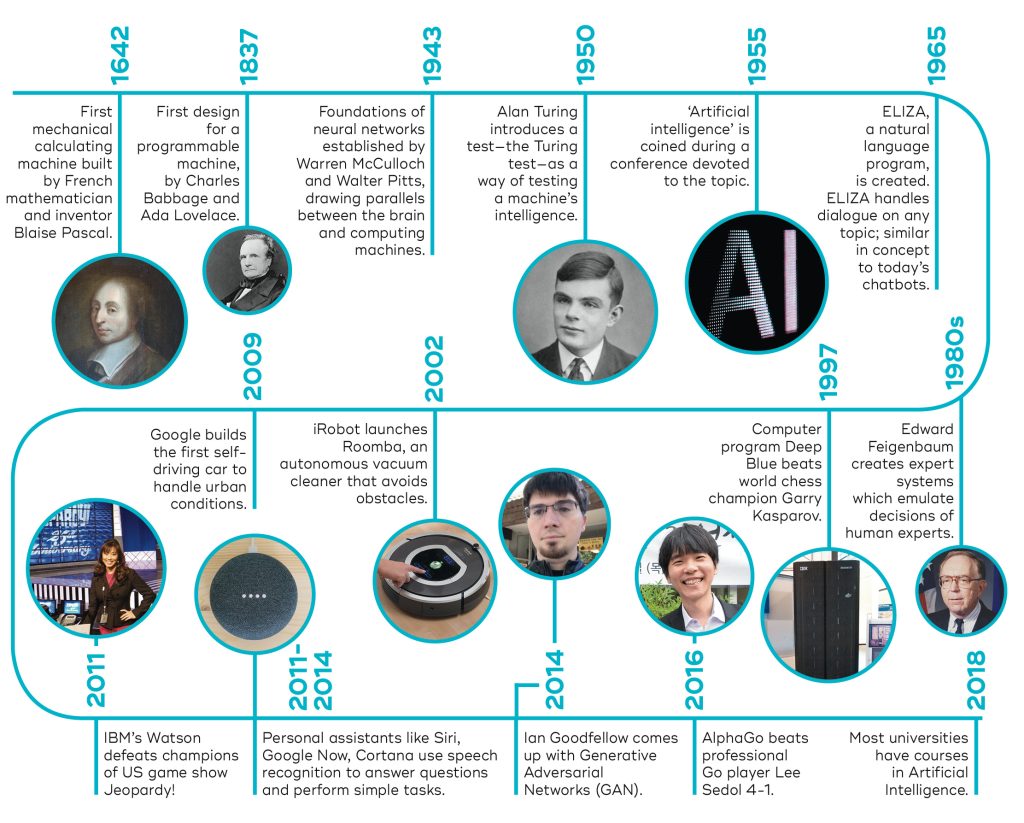

In 1956, a small group of scientists gathered for the Summer Research Project (funded by the Rockefeller Institute) conference at the Dartmouth College on Artificial Intelligence. This event is widely regarded as the birthplace of the discipline of Artificial Intelligence.

While the groundwork began years ago there have been many landmark achievements since then. This includes an extensive rise in the use and application of AI technologies like deep learning, machine learning, natural language processing, neural networks, and so on.

The 1990s to 2000s can be credited as the period of machine learning renaissance as we saw pioneering advancements in technologies related to artificial intelligence. This ignited a series of innovations that continue to revolutionize the AI industry.

From generative AI chatbots like ChatGPT and Gemini to analytical tools like Plus AI, artificial intelligence as a technology has become more mainstream over the years. Today, we are harnessing endless personal and commercial benefits of AI via technologies like workflow automation, data processing, speech recognition, and so on.

The AI phenomenon: An introduction

Anyone who is not living under the rock has heard the term AI, or artificial intelligence by now. However, unlike other buzzwords that often do not impact our lives directly, AI has the power to touch and influence our lives beyond imagination. The world understood that recently and there has been incessant discussion around AI since then.

This can be defined as the ‘AI phenomenon’ or the period of rapid and revolutionary growth of artificial intelligence technology that is striking every sector. It is leading to the widespread adoption of AI-powered solutions as businesses are integrating AI models in their products and services and using solutions driven by artificial intelligence.

As a result, there is also an increase in investments in research, development, and innovation centered around artificial intelligence. Venture capitalists, IT companies, and even governments and institutions are investing in AI in some way or the other.

As per the latest available data, there are around 67,200 artificial intelligence companies in 2024 and one in every four companies is based in the US. This number has doubled since the year 2017. Moreover, the current AI market size stands at around 184 billion US dollars and is expected to grow at a CAGR of 28.46 percent and reach 826.70 billion US dollars by 2030.

Clearly, AI is poised for huge growth and these numbers give only a sneak peek of the long journey. However, it will be important to not fall for the hype and hold one’s ground firm. As time passes by, many possibilities will unravel, and AI might see a fate that is currently unimaginable. Thus, we should be prepared for whatever comes our way.

Is AI the new dot-com bubble?

Economic bubbles occur when hefty (but pointless) investments are made in commodities leading to inflation in their market value and price. This can cause assets (good and bad) to appreciate excessively beyond their value to an unsustainable level, followed by a sudden crash.

As stated earlier, economic history has seen many such bubbles including the notorious dot-com bubble of the late 1990s and early 2000s. It was a stock market bubble that inflated between 1997 and 2000 and peaked on Friday, 10 March 2000.

This rapid growth happened alongside the widespread adoption of the World Wide Web and the Internet, resulting in a sudden growth of valuations in new dot-com startups. This was followed by a crash in October 2002, leading to huge losses.

During this dot-com bubble crash many online shopping and communication companies like Pets.com, Webvan, and NorthPoint Communications, failed and shut down. However, several online retailers like eBay and Amazon survived the crash and went on to become highly robust and profitable.

Notably, during this period investors were eager to invest in any dot-com company at any valuation. This was especially true for companies with Internet-related prefixes or a “.com” suffix, thus giving the bubble its name.

Now, following a similar pattern, many investors and companies are eagerly investing in products, services, and startups that have the term AI associated with them. There is an influx of such investments without the assurance of realistic revenue streams. In the absence of clear value propositions and sustainable business models, these businesses can also crash and fizzle out.

Despite all the hype and skepticism, businesses continue to adopt, implement, and invest in AI technology. This has led to a rise in talks about AI taking the form of a market bubble. Therefore, one cannot totally disregard the fact that this could be an indication of a dot-com-like phenomenon.

Of course, there will be heavyweights and larger players who will emerge powerful and profitable. However, currently, it is not possible for every investor, business, consumer, or organization to gauge the long-term scope and impact of artificial intelligence in its true sense. Thus, they might get usurped or acquired in the long run.

At the same time, it is obvious that AI will continue to grow more powerful in the coming years with genuine advancements. However, the inflated hype may cause ripples in the market that may have long-term negative impacts on the economy, and on our lives at large.

What are the factors responsible for the AI bubble?

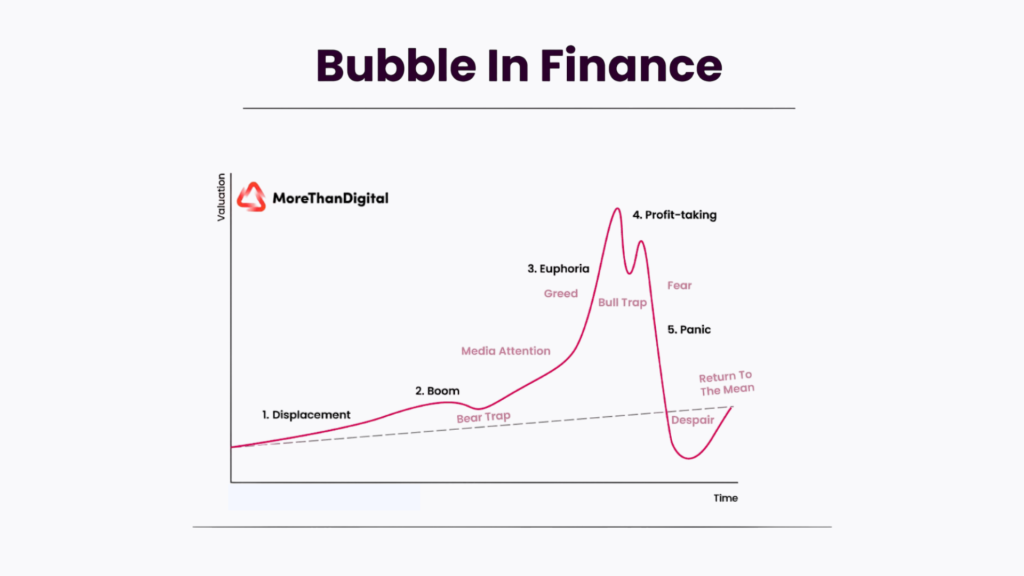

An economic bubble does not get formed overnight. Many factors and events cause inflation and lead to the crash or burst. However, before we discover the factors responsible for the AI bubble, it is important to understand the stages of the formation of a bubble. Go through them below:

5 stages of a market bubble

There are 5 stages of a financial or market bubble. They are as follows:

- Displacement: A displacement occurs when investors get infatuated with a new asset. This could be an innovative new technology like green technology, artificial intelligence, blockchain, and so on. The prices remain stable at this stage and there is limited media exposure.

- Boom: This stage occurs when the asset starts performing and attracting attention. Investors and the public start becoming more aware of its potential and there is positive coverage driven by a rise in value and uptrends.

- Euphoria: This is the stage where the mania for the asset develops and FOMO (Fear of Missing Out) pushes businesses and investors to enter the market. The coverage reaches its peak leading to limitless price escalation.

- Profit taking: This is the phase where the reality starts kicking in. The investors start selling and taking profits and there is cautious and speculative buying. The prices may remain inflated and stable or see a moderate decline.

- Panic: This is the phase where the smoke clears out leading to widespread fear and panic-driven decisions. The asset prices reverse and descend rapidly leading to the bursting of the bubble and exposure of reality.

Now that you know about the stages of a bubble, let us move ahead and discuss the factors that are likely responsible for the AI bubble.

Top factors likely responsible for the AI bubble

- Hype: There is over-enthusiasm, sensationalism, and excessive media coverage of AI posing it as the next big thing. Despite being fully aware of the scope and impact of the technology, there is an overvaluation of AI assets leading to mindless investments.

- Speculation: Not every investor or business might be capable of understanding AI technologies and their implications at a deep level. Surface-level information and trend-driven investments can lead to a flawed assessment of the long-term viability of the asset.

- FOMO: Every other business is investing in AI in some way or the other. The trends of the tech industry also show rapid adoption of AI technologies. This is causing the fear of missing out and investors are rushing into investments without proper diligence.

- High valuation: All the market hype and enthusiasm can lead to high hopes among investors and lead to inflated valuations of inadequate assets. However, unsustainable business models come with risks and lead to a loss of investments and resources.

- Ethical concerns: Concerns about data, privacy, bias, job displacement, and uncertainty are some of the issues threatening the AI industry. Other than that, over-promising and under-delivering is also a huge concern. This can lead to scrutiny and regulations, bursting the bubble eventually.

These are some of the factors likely responsible for the AI bubble. Additionally, global economic conditions, regional laws related to AI, limitations to real-world applications, etc., are some other factors that can cause a bubble. These issues terrorizing the AI industry can ultimately lead to a crash and fall.

Is the AI bubble about to burst?

At this stage when the prowess and reach of AI technology is rapidly growing, it is nearly impossible to predict if the AI bubble is about to burst, or if it exists at all. In fact, a bubble can only be confidently declared as a bubble when it bursts.

Thus, we cannot say if, and when, the bubble is poised to crash. However, it is true that most of the chaos around AI is hype, speculation, and conjecture. Once the dust settles, we will be more aware of the fate of AI technology and its future.

However, one cannot discount the fact that there are some honest efforts being made in the field of AI that are revolutionizing the world around us and making it better. There are many AI-powered projects with sustainable business models and long-term goals and perspectives that are set to grow beyond limits.

It is important to identify such projects and distance oneself from hype, sensation, and short-term fad. If not, we will continue to squeeze and inflate the bubble and it will become destined to burst in some way or the other.

Thus, we should keep our hopes and enthusiasm in check. Moreover, there are alternatives to “AI-powered” technologies and tools that are bringing about the same level of revolution without making tall and unnecessary claims. For example, no-code app builders, marketing and automation tools, project management software, etc., are also transforming the world around us.

Look out for such tools and technologies that add real meaning to your business and to your life. Do your due diligence before investing in any tool or technology and make the most of it. Do not fall for every platform that claims to be AI powered and subscribe only to meaningful ones.

We hope you now have a reasonable conclusion and some food for thought to go with it. Go on to dive deep into the world of AI and learn as much as you can. You can also check out our piece on AI app development and learn what is going on in the AI-powered app development industry. Until next time!

Frequently asked questions

What is a bubble?

The economic definition of a bubble can be summed up as a period of huge inflation of a given asset’s prices followed by a slump. It can be defined as an economic cycle that is characterized by the rapid escalation of the market value of a commodity. This rapid rise is then followed by a quick decrease in value that is often referred to as a “crash” or “bubble burst.”

What is the AI bubble?

Tools like ChatGPT and Gemini have made AI more mainstream and led to huge chaos and disruption. However, it is tough to fathom the exact impact of AI and chalk its future. Despite that, there are excessive expectations as far as AI’s capabilities and achievements are concerned. Thus, one can say that we are going through a period of inflated excitement, hype, and investments centered around artificial intelligence that can be defined as the AI bubble.

Are we in an AI bubble?

An economic bubble usually occurs when there is a sudden spike in investments centered around a particular asset like AI technology. Without clear value creation and long-term viability, these investments can incur losses and lead to a sharp and sudden decline in profits.

Now, the sudden hype around AI has forced businesses to start investing in artificial intelligence technology without fully understanding its scope and impact. Many businesses have started loosely throwing around the terms “AI” and “AI-powered” without truly utilizing the technology. If this trend continues, it can soon take the form of a bubble and inevitably burst in the coming time.

Will the AI bubble burst?

AI as a technology is not just hype. It is highly promising, and the future certainly holds endless possibilities. However, the market cannot rely on eventualities, and inflated investments in AI without clear value creation can definitely lead to a bubble. If this trend continues, there may come a day when the bubble bursts and impacts society at large. However, this can be avoided if businesses and investors are more calculative and prudent about investing in artificial intelligence.

How long will the AI bubble last?

It is nearly impossible to predict the life of any economic bubble as it is driven by a multitude of factors. These drivers are often ambiguous such as market sentiment, continued technological advancements, imposed regulations, and so on. Besides, one cannot discount the fact that AI is a powerful technology, and it will play a vital role in shaping our economy in the future. Therefore, even if the bubble bursts, the innovations, research, and advancements in this field will continue to power the world and make an impact.

What will be the effect of the AI bubble burst?

AI technology will continue to grow and expand in the coming years. However, if the AI bubble bursts, it can have a huge impact on the market and industry trends. For example, it can lead to the following:

- The technological landscape may get reshaped and ultimately affect the production and innovation in industries powered by AI.

- Investors may incur losses and eventually stop investing in AI-based projects and startups due to a lack of trust and confidence.

- Investments in AI research and development may get reduced leading to loss of jobs and opportunities.

- Established and strong players may wipe out or acquire small businesses centered around AI technology.

- Raised concerns around the safety and security of investors and consumers may lead to increased restrictions and regulations.

Is AI the future?

Artificial intelligence is not just a buzzword but a technology full of immense potential. It is revolutionizing many industries and changing them for the better. From healthcare to education, lifestyle, entertainment, logistics, and more, artificial intelligence is empowering many realms. Businesses are adopting and investing in AI technologies to optimize their workflows, enhance customer experiences, and so on. In a nutshell, the application and utilization of AI is growing nonstop. Therefore, it is safe to assume that AI, like any other emerging and powerful technology, is going to shape our future.

How to invest safely in AI?

Whether you are a business, an investor, or even a customer, you must take a calculated approach when it comes to adopting or investing in AI technology. Keep yourself informed and aware of the latest changes, developments, and hazards concerning the industry. Do not fall for the hype and do the due diligence on the product or business you are planning to invest in. Identify products or services with potential, value proposition, and sustainable business model. You can diversify your investments and not bank upon only one sector, technology, or business. Take data-backed decisions and assess your profits and risks. By following these standard practices, you will be able to invest safely in AI and get your money’s worth.